Remaining Balance Method . the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. what is the declining balance method of assets depreciation? the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. Under the declining balance method, depreciation is charged on the book. the diminishing balance method, also known as the reducing balance method, is a method of calculating. the declining balance method of depreciation is also called the reducing balance method, where assets are.

from www.slideserve.com

Under the declining balance method, depreciation is charged on the book. the diminishing balance method, also known as the reducing balance method, is a method of calculating. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. the declining balance method of depreciation is also called the reducing balance method, where assets are. what is the declining balance method of assets depreciation?

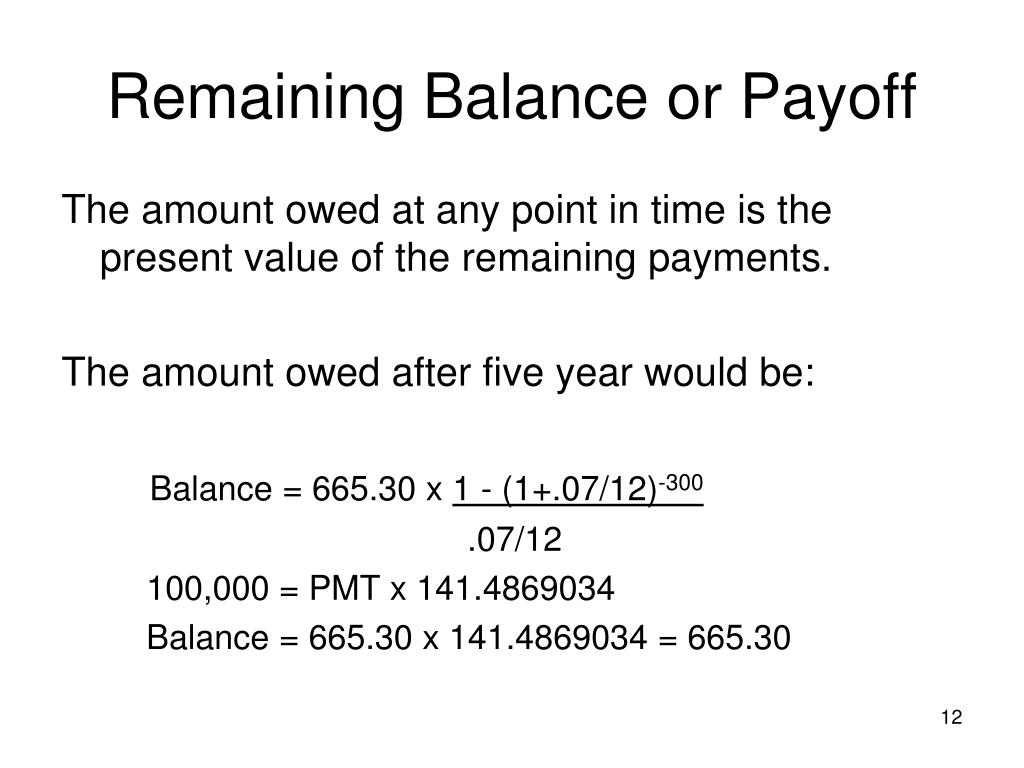

PPT Chapter 4 PowerPoint Presentation, free download ID5760347

Remaining Balance Method Under the declining balance method, depreciation is charged on the book. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method of depreciation is also called the reducing balance method, where assets are. Under the declining balance method, depreciation is charged on the book. the diminishing balance method, also known as the reducing balance method, is a method of calculating. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. what is the declining balance method of assets depreciation?

From www.youtube.com

The Installment Loan Formula Determining Remaining Balance YouTube Remaining Balance Method the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. Under the declining balance method, depreciation is charged on the book. what is the declining balance. Remaining Balance Method.

From www.slideserve.com

PPT Chapter Objectives PowerPoint Presentation, free download ID Remaining Balance Method the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. Under the declining balance method, depreciation is charged on the book. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. what is the declining balance method. Remaining Balance Method.

From www.slideserve.com

PPT Chapter 4 PowerPoint Presentation, free download ID5760347 Remaining Balance Method the diminishing balance method, also known as the reducing balance method, is a method of calculating. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. Under the declining balance method, depreciation is charged on the book. the declining balance method of depreciation is also called the reducing balance. Remaining Balance Method.

From accountingcorner.org

Double Declining Balance Method of Depreciation Accounting Corner Remaining Balance Method the declining balance method of depreciation is also called the reducing balance method, where assets are. what is the declining balance method of assets depreciation? the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. a declining balance method is used to accelerate. Remaining Balance Method.

From www.coursehero.com

[Solved] The E.N.D. partnership has the following capital balances as Remaining Balance Method the diminishing balance method, also known as the reducing balance method, is a method of calculating. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method of depreciation is also called the reducing balance method, where assets are. what. Remaining Balance Method.

From www.youtube.com

preparation of trial balance, balance method and total method trial Remaining Balance Method the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method of depreciation is also called the reducing balance method, where assets are. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the.. Remaining Balance Method.

From www.youtube.com

Solving equations using the Balance method YouTube Remaining Balance Method the declining balance method of depreciation is also called the reducing balance method, where assets are. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether.. Remaining Balance Method.

From accountingcorner.org

Double Declining Balance Method of Depreciation Accounting Corner Remaining Balance Method Under the declining balance method, depreciation is charged on the book. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. the diminishing balance method, also known as the reducing balance method, is a method of calculating. the formula for the remaining balance on a loan can be used. Remaining Balance Method.

From www.slideserve.com

PPT MIE 754 Class 7 Manufacturing & Engineering Economics Remaining Balance Method Under the declining balance method, depreciation is charged on the book. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. what is the declining balance method of assets depreciation? the. Remaining Balance Method.

From www.slideserve.com

PPT Reducing Balance Method PowerPoint Presentation, free download Remaining Balance Method the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. Under the declining balance method, depreciation is charged on the book. the diminishing balance method, also. Remaining Balance Method.

From www.coursehero.com

[Solved] Find the monthly payment and estimate the remaining balance Remaining Balance Method what is the declining balance method of assets depreciation? the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. Under the declining balance method, depreciation is charged on the book. a declining balance method is used to accelerate the recognition of depreciation expense for. Remaining Balance Method.

From the-world-is-my-classroom.weebly.com

Unit 6.2 Solving Equations Using Balance Strategies MR. MARTÍNEZ'S Remaining Balance Method a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. the diminishing balance method, also known as the reducing balance method, is a method of calculating. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. Under the declining balance method, depreciation. Remaining Balance Method.

From www.slideserve.com

PPT MIE 754 Class 7 Manufacturing & Engineering Economics Remaining Balance Method the diminishing balance method, also known as the reducing balance method, is a method of calculating. a declining balance method is used to accelerate the recognition of depreciation expense for assets during the. what is the declining balance method of assets depreciation? the declining balance method of depreciation is also called the reducing balance method, where. Remaining Balance Method.

From www.smartcapitalmind.com

What Is a Remaining Balance? (with pictures) Remaining Balance Method what is the declining balance method of assets depreciation? the diminishing balance method, also known as the reducing balance method, is a method of calculating. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. a declining balance method is used to accelerate the recognition of depreciation expense. Remaining Balance Method.

From accountingcorner.org

Double Declining Balance Method of Depreciation Accounting Corner Remaining Balance Method the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. a declining balance method is used to accelerate the recognition of depreciation expense for assets during. Remaining Balance Method.

From www.slideserve.com

PPT Reducing Balance Method PowerPoint Presentation, free download Remaining Balance Method the declining balance method in accounting is an accelerated depreciation system of recording larger depreciation expenses during the. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. a declining balance method is used to accelerate the recognition of depreciation expense for assets during. Remaining Balance Method.

From www.awesomefintech.com

Adjusted Balance Method AwesomeFinTech Blog Remaining Balance Method the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. Under the declining balance method, depreciation is charged on the book. what is the declining balance method of assets depreciation? the declining balance method of depreciation is also called the reducing balance method, where. Remaining Balance Method.

From dreamstime.com

Remaining Balance Royalty Free Stock Photo Image 70255 Remaining Balance Method what is the declining balance method of assets depreciation? Under the declining balance method, depreciation is charged on the book. the formula for the remaining balance on a loan can be used to calculate the remaining balance at a given time(time n), whether. the diminishing balance method, also known as the reducing balance method, is a method. Remaining Balance Method.